In the fast-paced world of sneaker collecting and reselling, the oopbuy spreadsheet

The Rise of Data-Driven Sneaker Culture

With the global sneaker resale market projected to reach $30 billion by 2030, collectors and entrepreneurs increasingly rely on tools like oopbuy's comprehensive spreadsheet to:

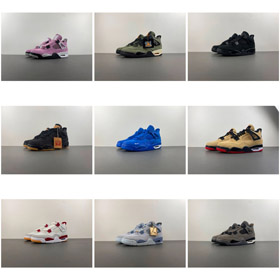

- Track historic price fluctuations across different AJ (Air Jordan) models

- Identify emerging markets and regional price discrepancies

- Monitor supply levels of limited-edition releases

- Analyze colorway popularity across different demographics

How Enthusiasts Leverage the OOPBUY Spreadsheet

Advanced collectors have developed sophisticated methodologies for extracting value from this shared resource:

Case Study: AJ1 Retro High Analysis

By comparing columns for release frequency, territory exclusivity, and historical appreciation rates, users can predict which upcoming drops warrant cross-border purchases.

The spreadsheet's collaborative nature allows community members to contribute real-time data on:

- Custom duties and import taxes in different regions

- Last-size availability patterns

- Emerging premium categories (e.g., collaborations or OG reissues)

2024 Key Trends Identified in oopbuy Data

| Trend | Growth Indicator | Primary Markets |

|---|---|---|

| Women's exclusive colorways | +47% YOY demand | APAC, EU |

| "Lost and Found" retro styles | 2.3x resale multiplier | North America |

| Regional exclusives | 5-8% monthly appreciation | Cross-border |

As international sneaker markets become increasingly interconnected, platforms like oopbuy empower enthusiasts to transform casual collecting into data-informed investments. The spreadsheet's evolving categories now extend beyond just footwear, encompassing complementary products like special edition apparel and collector accessories.

Savvy participants recognize that in the landscape of cross-border sneaker commerce, metadata is becoming as valuable as the physical products themselves.